Anansi Shipping Insurance for Shopify Stores

Fed up with wasting time on delivery issues?

It’s now easier than ever to recover from shipping mishaps with automated claims, fast reimbursements, coverage for loss, damage and more.

But best of all, we cover shipments sent with all the major couriers, yet they’re removed from the claims process entirely!

Finally, no more filing claims or waiting for couriers' approval.

¹ UK to UK only.

Protect your customer deliveries, reputation and bottom line

No matter what happens to your shipments while in transit, across any of your preferred couriers, know your customer deliveries are covered for loss and damage.

¹ UK to UK only.

How does the Anansi app help your Shopify business?

It’s simple. There’s no need to file a claim or chase its status. Ever.

Claims for lost parcels trigger automatically. Reimbursements are paid directly into your bank account every month.

Damage claims require 30 seconds of your time with an online form and a photo.

CALL INSURER

SEND EVIDENCE TO INSURER

CALL FOR DECISION

CASH CHEQUE

REFUND CUSTOMER

GATHER EVIDENCE

WAIT 30 DAYS

RECEIVE CHEQUE PAYOUT

WAIT 5 BUSINESS DAYS

PLATFORM TRIGGERS CLAIM

CLAIM PAID DIRECT TO BANK

It's that simple!

Don’t just take our word for it.

See what Shopify businesses are saying about the Anansi app.

FAQs

How do I get started?

Visit the app store and click “add app” to install. It is really simple. Just a few questions about your business and contact information.

Once I have downloaded the app, what next?

The app will take you through a short account creation process. During account creation, you’ll be able to customise the insurance coverage by using a slider tool to select which orders you’d like to insure, based on

- Retail value: Insure orders based on their retail value.

You will use the slider tool to select the minimum and maximum retail values of orders to insure, confirm your business details, and click to review your quote and accept the policy terms. Once accepted, an insurance policy is automatically created and can be found in “Policy”. It will also be emailed to you for your records.

Note: Once you have set your order value preferences, all orders within the selected range will automatically be insured.

When does my cover start?

The cover starts on the day you click to agree the terms.

How do I make changes to my order value preferences?

You can make changes to the rules at any time from the “My Account” feature within the app. The changes come into effect immediately and are applied to all subsequent orders from then on.

How can I configure my coverage?

During account creation, you will use a slider tool to select the minimum and maximum retail values of orders that you’d like to insure. You have the choice of insuring goods based on:

- Retail value: Insure orders based on their value, and any order sold at or above the amount will be insured automatically.

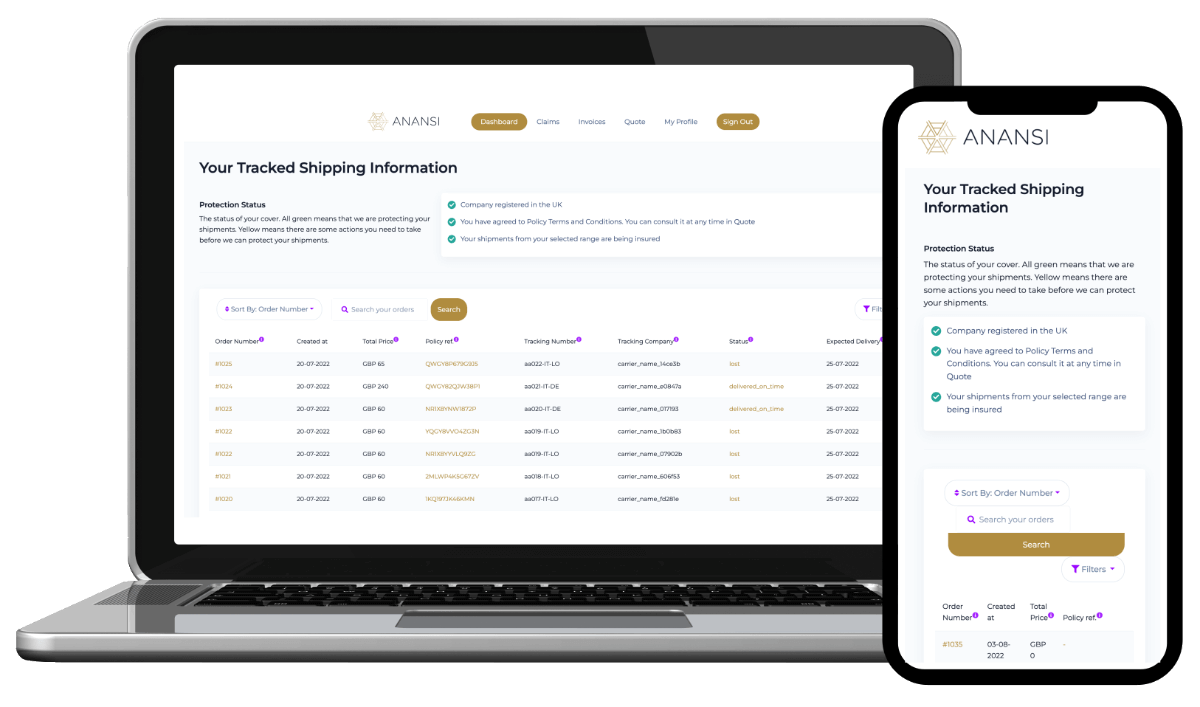

What do I use the app features for?

- Dashboard: see the delivery status of all your insured parcels.

- Policy: view your policy.

- Claims: check the status of your claims.

- Invoices: make your premium payments.

- My Account: make changes to your stored business and contact details and range of retail.

What are my parcels covered for?

Included in your policy, for:

- Parcels sent UK to UK are covered for loss and damage.

- Parcels sent UK to International are covered for loss and damage.

- Coverage is up to the value of £25,000 (per parcel).

- It is multi-courier coverage so parcels sent with any courier are covered.

Does the policy carry an excess?

- No, your policy carries £0 excess.

What are the minimum and maximum retail values I can cover?

There really is no minimum. And the maximum shipment you can insure is £25,000. You can change the minimum and maximum retail values, selected during account creation, within the “My Account”’ feature. Once selected, the values are then reflected in your policy and displayed in the “Policy” section.

Where is the coverage?

The cover provided by this insurance applies to businesses based in England, Wales, Scotland, the Channel Islands, the Isle of Man and Northern Ireland. It covers items in transit from the UK to worldwide (excluding sanctioned countries). We will be adding coverage for businesses in other geographic territories (starting in the EEA).

Are any commodities excluded from coverage?

The following items are excluded: Aerosols, soft or alcoholic drinks, ammunition, batteries (unless the batteries are already, cash, clinical and/or medical waste, corrosive materials, environmental waste, explosives, flammable substances, fur, gases, jewellery, perishable goods, precious metals, radioactive materials and samples, solvent based-paints, tobacco, wood varnishes, works of art. Or any items listed as prohibited or restricted under the Courier's terms and conditions.

Does the insurance cover all couriers?

Yes.

Are premiums higher with certain couriers?

No. At the moment, the premium is the same irrespective of which courier firm is used.

Isn’t this double insurance? Do you claim insurance from couriers?

No it is not and no we don’t! Most couriers offer a small amount of protection within the basic shipping fee. For example, DX’s is £25, Hermes £20, and DHL £12, but typically it does not cover the full extent of the loss and can take a long time and administration to claim.

The goal of the Anansi app is to ensure that you have full insurance coverage up to a maximum of the full retail value for shipped items.

How do I submit a claim?

For lost parcels, you don’t! Yes, you read that right. Loss claims are automatically triggered and created for you when a predefined time threshold has been met. You will see them appear in the “Claims” feature.

When are lost claims automatically triggered (i.e. what are the predefined time thresholds)?

FOR UK TO UK PARCELS

Delayed: If a parcel is not delivered 1 working day after its expected delivery date, the Anansi app flags it as a delay and adds it to the total to be paid during the next claims cycle.

How do I submit a claim for a damaged parcel sent from the UK to a UK destination?

Select “Create new damage claim” from the “Claims” feature and enter a few facts about the shipment, upload a photo, and submit. The Anansi claims team will review and assess the extent of the damage and decide on the claim value. They may have follow-up questions if the evidence provided is incomplete or insufficient.

For a damaged parcel sent from the UK to a UK destination, what am I reimbursed?

It depends on the extent of the damage. But maximum reimbursement is the retail value plus the shipping costs.

FOR UK TO INTERNATIONAL PARCELS

The time threshold for a lost claim to trigger, and its reimbursement value is exactly the same as described above for UK to UK parcels.

How do I submit a claim for a damaged parcel sent from the UK to an international destination?

Again, it’s exactly the same process as above. Select “Create new damage claim” from the “Claims” feature and enter a few facts about the shipment, upload a photo, and submit. The Anansi claims team will review and assess the extent of the damage and decide on the claim value. They may have follow-up questions if the evidence provided is incomplete or insufficient.

For a damaged parcel sent from the UK to an international destination, what am I reimbursed?

It depends on the extent of the damage. But a maximum reimbursement is the retail value plus the shipping costs.

GENERAL CLAIM QUERIES

What documentation is needed for a claim?

None for loss, a photo for damaged goods.

How do I check the status of my claim?

The status of all your claims can be viewed in the app “Claims” feature, at any time. You can see all claims with their relevant status: New, In Assessment, Awaiting information, Declined, Withdrawn, Duplicate, Approved, and Paid giving you peace of mind that a reimbursement is definitely taking place which allows you to reship a replacement to your customer.

How much time does it take to get paid?

What if the payment date falls on a weekend or a bank holiday?

If the payment date falls on a weekend or a bank holiday, the claim will be paid on the next working day after the weekend or bank holiday.

Why do you have an audit period?

The app is designed to work using parametric triggers from parcel tracking data. At peak times, there can be a lag in the receipt of delivery data. Therefore, a 5 day audit period is necessary to check whether an item is lost, or if it was delivered on time and we failed to receive the information in a timely manner. Also, as part of Anansi's regulated duties, our insurance partner requires verification that a loss actually occurred before a claim is paid.

What happens if the item arrives during the 5 day audit period?

In this case, a lost parcel hasn’t happened so the pending claim would not be converted into a confirmed loss claim.

What happens if the item arrives after the 5 day audit period?

If the audit period is complete, the claim is confirmed and automatically added to the next claim cycle. However, once the claim is paid, this item is then the property of the insurance company, so we may request that it be sent to Anansi for salvage purposes.

What happens when an item is marked delivered in the tracking data but the customer disputes the delivery?

Because the Anansi app is powered by parcel tracking data, the system automatically registers an item as delivered. If this happens, please contact customer services via .

Is there a cost for the app?

No! The app is free to install. You only pay for the coverage you need.

How is the cost of my insurance coverage calculated?

The cost is calculated using the below percentages of the retail value on each order.

Orders sent from the UK to a UK destination cost 1.5% of the retail value.

Orders sent from the UK to an International destination cost 1.8% of the retail value.

How am I invoiced?

Invoices are automatically created monthly on the 1st of the month and displayed in the “Invoices” feature. You have 7 days to settle your balance and can pay your invoice online directly from the app.

What forms of payment do you accept?

You can pay via bank transfer or card directly from the app within the “Invoices” feature. We accept Visa, Mastercard and American Express.

Who do I contact if I have more questions?

You can email us at for any questions you may have.

How do I cancel my account?

We are sorry to see you go. But if you want to cancel your account, please give 14 days written notice via or go to “My Account” and set the order range to zero (0).

How do I delete the app?

Click on the “Apps” tool in your Shopify Admin, then click “Delete” in the row of the app that you want to uninstall. Click “Delete” again in the message that appears. After receiving notice of uninstalling the app, you will no longer be receiving coverage on any fulfilled orders. Orders made after uninstallation will not be covered by Anansi.

After the app is uninstalled you will need to reach out to our team at to cancel your policy.

What do I do if I want to dispute a claim?

If you have a query or want to dispute a claim, you can contact the Anansi Customer Services team:

How do I make a complaint?

We aim to provide the highest standard of service, but we do understand that dissatisfaction can arise. If the complaint concerns the administration of the policy or the management of a claim please contact:

Trouble downloading the app?

In most scenarios this is related to the internet browser or an extension. Try using a different browser or temporarily disabling the extensions on your current browser. You may also want to check your browser is set to allow certain pop-ups and clear your cache.

What is Anansi’s regulatory status?

Anansi Technology Limited (registered in England No. 11420090) is an Appointed Representative of Resolution Underwriting Partnership Limited, who are authorised and regulated by the Financial Conduct Authority (FRN 308113) in respect of general insurance business and is registered in England No.05104119.

Where is the Insurance Protection Information Document (IPID)?

Click here for a copy of the IPID.