March 14 2023 | MARKETING

Understanding the Differences between Carrier Liability and Automated Goods-in-Transit Insurance

As an e-commerce business owner, the last mile delivery process is a critical part of the customer experience. It is the last chance to provide customers with a good experience and reinforce their trust in your business. But it is during this phase of transit that shipments are most vulnerable to getting lost, damaged or delayed.

- Lost deliveries. 51% of e-commerce buyers, during a 6 month period, didn’t receive at least one item that they’d ordered.

- Damaged packages. In transit, items are dropped frequently and product damage happens – on average 17 times on route. And it’s especially common with oversized items, such as pieces of furniture. A study from uShip found that 21% of respondents who had ordered a large item in the past year had seen it show up damaged. But product damage is commonplace with all types of e-commerce items: A large study found that 11% of UPS items showed up with damage, as did 10% of USPS items and 7% of FedEx packages.

- Delayed parcels. According to a recent study, almost half of all UK deliveries are delayed, with 41% of consumers claiming their most recent order was delayed.

In any of these scenarios, customers will demand a refund, cancel their order, or ask you to ship an expedited replacement. Meanwhile, you incur the loss of a product or are left with damaged goods to reclaim, repair, resell or right off. And your reputation takes a hit whatever the mishap.

With so much at stake, it is essential to ensure that goods are properly insured during this critical part of your shipping process. But so few e-commerce businesses have adequate protection in place; with a staggering 90% of goods in transit under or uninsured.

One of the main causes of this gap in protection is that businesses rely on carrier liability to protect their goods, and often misunderstand the parameters of its cover.

So what exactly is carrier liability cover?

Carrier liability cover is included as standard within carrier shipping costs and protects against loss and damage to products caused by the negligence of the carrier, whilst in their possession. It’s not real insurance or designed to protect you; the shipper, it is intended to protect the carrier from fraudulent claims made against

missing or damaged goods.

It’s governed by a series of parameters, typically found in the shipping policy small print, that can often go overlooked or unseen by shippers.

What are the common carrier liability parameters?

1. Burden of proof

- It’s on the shipper, you, to prove that the loss or damage happened while the goods were in the physical control of the carrier.

2. Limitations

- Damage that goes un-noted on the delivery receipt is invariably not covered.

- Cover included is up to a certain value. DPD, for example, provides standard cover of up to £50.

- Payouts are capped, irrespective of an item’s full retail value, typically around £50-100, but it varies by carrier.

3. Exclusions

If goods are damaged by other means, such as…

- When damage is caused by inclement weather (Acts of God) or;

- If a product is deemed inadequately packaged (Acts of Shipper)

Or the goods are listed within the carrier’s prohibited items:

- Prohibited items are often extensive, some are covered only for loss and not damage, like an iMac for instance with Evri.…then the shipper has no grounds to make a claim. Which brings us to claims.

Claims culpability

Proving that a carrier is to blame for a shipping mishap and receiving a successful compensation involves navigating a claims process. Largely manual, it’s often arduous and lengthy. You are likely to face a number of limitations during a carrier claims process such as:

- The claim has to be filed within 9 months of delivery

- The receipt of delivery has to include notice of damage

- Proof of value and loss is required

- Carrier’s have 30 days to acknowledge your claim and have to respond within 120 days

- Claim payments generally do not cover the loss experienced by the shipper

- The manual process involves uploading documents, completing forms, sending emails, and communicating via the phone or live chat

So, whilst carrier liability can provide a measure of protection for certain shipping-related incidents for items of relatively low retail value, the right to compensation hinges on the fulfillment of quite specific requirements and proof of the carrier’s fault.

What are the alternatives to statutory carrier liability?

Enhanced carrier insurance

Businesses can opt to purchase enhanced carrier protection policies which, unlike statutory liability, are considered to be real insurance and provide coverage for items up to a far higher value.

Coverage limits, and the list of non-compensation products excluded from the cover, still apply and vary considerably by carrier. Evri, for example, offers additional insurance cover for items above £20, up to the value of £999 whereas DPD provides enhanced insurance up to £5000.

In terms of claim reimbursements, they are fairer in comparison to carrier liability cover, but the insurance is still sold and managed manually. The claims process, for instance, still relies heavily on the shipper completing a series of manual tasks and has similar limitations within the claims process.

Payouts tend to be quicker but, on average, claimants still wait 30-60 days from the claim submission date to receiving a claim settlement. Which means there’s still a big impact on the cash flow because your business has to absorb the loss internally whilst you rectify the delivery issue with the customer, all without the financial security of reimbursement.

Third party insurance

To be truly covered for loss-protection equal to the actual value of goods being shipped, businesses should consider third party insurance. One in which limitations and exclusions are few, the coverage protects against physical loss, damage or delay while in the ordinary course of transit, and does not require proof of culpability. If done correctly, nothing in the supply chain will protect a company’s financial interest as well as this type of insurance.

However, not all third party insurance providers are equal. When considering taking out a policy with a third party, it’s essential to understand whether the insurance product is manual or automated. If manual, you will likely still face frustrations and delays during the claims process. Alternatively, there are automated solutions that eradicate both the frustrations and the time lags.

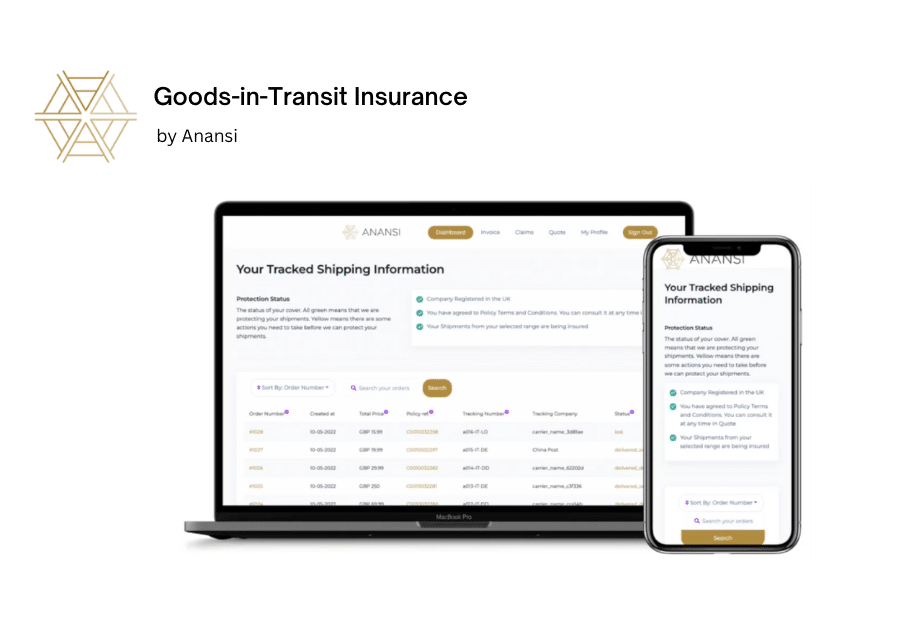

Anansi provides an automated solution for goods-in-transit insurance that is designed to specifically deliver where carrier liability does not, by putting the needs of your e-commerce business at the heart of the proposition. To understand the differences, let’s compare the two in more detail.

Comparison of Carrier Liability and Anansi Goods-in-Transit Insurance

Costs

- Carrier Liability is generally included in the quote a carrier provides for your shipment, but it can also depend on what you’re shipping and the carrier’s rate for that type of commodity. However, what e-commerce businesses often misunderstand is that the value of the liability cover is often much less than the value of your items as payouts are capped (more on this below).

- Anansi Goods-in-Transit Insurance is elective coverage meaning you can purchase it or not based on the actual retail value of your items. The monthly fees (no excess), are 1.5% of the retail value of each item sent within the UK and 1.8% of the retail value of items shipped from the UK to international destinations. Unlike carrier liability, you are covered for the full-value of your items and payouts are uncapped.

Claim filing

The process for filing a claim differs drastically depending on whether you rely solely on your carrier’s limit of liability or opt to use the automated Anansi solution. Essentially, it’s either manual or automated.

- Carrier Liability claims have to be filed manually. And if using more than one carrier, you will need to file separate manual claims with each carrier involved.

- Anansi Goods-in-Transit Insurance automates claim filing for goods that are lost or delayed. Parametric insurance triggers the creation of a claim each time an expected delivery date goes unmet or is exceeded. No requirement to file lost and delayed claims manually or navigate different carrier claims processes, claims file instantaneously across all the carriers you ship with.

Claim timelines

With Carrier Liability you must file a claim within a certain time frame, 14 days for DHL, 21 days after the delivery of the shipment or the expected delivery date for delivery for TNT. Carriers have 30 days to acknowledge a claim and 120 days to respond. Depending on what supporting documentation is required, it might take longer.

With Carrier Liability you must file a claim within a certain time frame, 14 days for DHL, 21 days after the delivery of the shipment or the expected delivery date for delivery for TNT. Carriers have 30 days to acknowledge a claim and 120 days to respond. Depending on what supporting documentation is required, it might take longer. - With Anansi Goods-in-Transit Insurance claims for lost items are filed automatically 10 days after the expected delivery date has passed and claims for UK to UK delayed goods, vary by carrier, but typically auto-file 1 day after the expected delivery date. All claims, irrespective of whether they relate to a parcel getting lost, damaged or delayed, are typically agreed within 72 hours.

Claim culpability

The issue of fault is distinctly different between carrier liability and Anansi goods-in-transit insurance.

- Under Carrier Liability the shipper must prove that the damage or loss is the carrier’s fault and provide evidence of value and loss.

- With Anansi Goods-in-Transit Insurance, we only need to see that damage or loss occurred while the goods were in the carrier’s possession.

Claim reimbursements

Carrier Liability. If the carrier accepts culpability they either pay for the cost of repair or the manufacturing cost, not the retail sale price. But the liability payout is also capped and varies by carrier, typically around £50-100. So, if you suffer a loss that exceeds the capped value then the carrier won’t have to pay the difference. It’s also not unusual for carriers to pay a partial claim, acknowledging a degree of fault, with an explanation as to why they are not fully liable.

Carrier Liability. If the carrier accepts culpability they either pay for the cost of repair or the manufacturing cost, not the retail sale price. But the liability payout is also capped and varies by carrier, typically around £50-100. So, if you suffer a loss that exceeds the capped value then the carrier won’t have to pay the difference. It’s also not unusual for carriers to pay a partial claim, acknowledging a degree of fault, with an explanation as to why they are not fully liable. - Anansi Goods-in-Transit Insurance offers full retail value reimbursements plus the shipping costs for lost items, up to the full retail value for damaged parcels, and the shipping costs for delayed items sent domestically. No capped compensation or proof of culpability.

What’s covered and not covered?

- Carrier Liability does not cover concealed damage, weather, acts of God, or damage that results from improper packaging or loading. In these cases the carrier is not at fault and, if damage is not noted on the delivery receipt, carriers attempt to deny liability.

- Anansi Goods-in-Transit Insurance covers more commodities than carriers and covers types of damage for any reason. However, there are standard commodities that are not covered (see list of exclusions here).

What is the best approach for my e-commerce business?

There is no doubt that an automated approach to insuring goods can offer your business increased value, efficiency and financial security, particularly in relation to the claims process. It’s stressful enough losing goods on route to your customers, filing a claim should not add to the strain.

But, whether you choose to rely solely on carrier liability cover or Anansi goods-in-transit insurance, or look to implement a mix of the two, depends on:

1. The average order value of your goods;

2. The frequency of loss and;

3. The financial and operational impact that carriers claim limitations and processes has on your business.

We recommend taking a look into the data from the past 6 months to a year, and establish how frequent the losses occur and at what average order value your business starts to incur a financial loss. Armed with this information you are ready to explore two options.

Option 1: Carrier liability + Anansi insurance above carrier capped values

If carrier liability cover is adequately protecting your company from financial loss, we recommend setting up the Anansi insurance to cover goods above the carrier’s capped reimbursement value. For example, if your average order value is relatively low, under £80, and losses are few, carrier liability cover could be financially adequate for your goods valued up to £80. In this case, you can set the Anansi insurance to begin above this financial inflection value. Once set, all orders above the selected value will be automatically insured with Anansi.

The only aspect you need to carefully consider with this route is that you will be managing claims across both the carrier(s) and Anansi.

Option 2: Anansi insurance cover from £0.00+

Alternatively, you may choose to cover the value of your entire product range with Anansi, from zero to the highest item’s value. This route avoids having to navigate a carrier claims process and removes all work associated with filing claims for lost and delayed orders. Plus, in the event of a shipping mishap, you’ll have full coverage for the total value of your goods versus a capped cost price.

Once you’ve established how frequent your customer shipments go missing, get damaged and are delayed in transit and know the value at which your business loses out, you can confidently implement a plan to ensure all your goods are adequately protected.

Having real insurance, whether in replacement of, or in addition to, carrier liability will allow you to better protect your finances, workload and customer experience. To discuss automated goods-in-transit insurance or see it in action, click here to book a session with us.

Recommended Articles

Embracing the Festive Frenzy: How To Navigate Ecommerce Challenges as Xmas Approaches

The transition from the bustling Black Friday and Cyber Monday sales to the festive Christmas season is a crucial time for ecommerce. It’s a period teeming with opportunities as consumers rush to fill their online baskets with gifts and goodies. However, this heightened activity brings its own set of challenges, making it a critical time […]

5 Things to Consider When Choosing Ecommerce Parcel Insurance

In the fast-paced world of ecommerce, ensuring the safe and secure delivery of your parcels is essential. With the ever-present risks of theft, damage, and loss, having ecommerce parcel insurance can make all the difference in protecting your business and keeping your customers satisfied. Here are five crucial factors to consider when deciding whether to […]

Anansi partners with Tokio Marine HCC, Liberty Mutual and Arch Insurance

We are pleased to collaborate with Tokio Marine HCC, Liberty Mutual and Arch Insurance to introduce a pioneering parametric goods-in-transit insurance tailored for large retailers. With Tokio Marine HCC as the lead insurance capacity provider and underwriter, and the arrangement facilitated by GAWS of London, a notable wholesale broker in the Lloyd’s market, this venture […]